Buildings and construction (VAT Notice 708)

1. Overview

This notice explains:

You should read this notice if you:

This notice may also help if you, as the customer or client of a contractor, subcontractor or developer, wish to satisfy yourself about the correct liability of the supplies of goods and services being made by them to you.

This is especially so in the case of DIY house builders and converters (‘self builders’), who contract VAT-registered builders or tradesmen to carry out construction or conversion services and are charged VAT on those services. Some, if not most, of the VAT charged can be recovered by the self builder through the provisions of the DIY house builders and converters VAT Refund Scheme but only where that VAT that has been correctly charged in the first place.

The Value Added Tax Act 1994, Section 30 holds that goods and services specified in Schedule 8 to the Act are zero-rated.

Schedule 8, Group 5 (as amended by SI 1995/280, SI 1997/50, SI 2001/2305, SI 2002/1101 and SI 2010/486) specifies when the construction (and the supply of building materials with those services), conversion of a non-residential building (and the supply of building materials with those services), sale, or long lease of a building is zero-rated.

Schedule 8, Group 6 (as amended by SI 1995/283, SI 1995/1625 (NI 9) and the Planning (Consequential Provisions) (Scotland) Act 1997) specifies when the alteration (and the supply of building materials with those services), sale, or long lease of a protected building is zero-rated.

The Value Added Tax Act 1994, Section 29A (as inserted by the Finance Act 2001, section 99(4)) holds that goods and services specified in Schedule 7A to the Act are reduced-rated.

Schedule 7A, Group 6 (as inserted by Finance Act 2001, section 99(5) and amended by SI 2002/1100) specifies when a residential conversion is reduced-rated.

Schedule 7A, Group 7 (as inserted by Finance Act 2001, section 99(5) and amended by SI 2002/1100 and SI 2007/3448) specifies when the renovation and alteration of a dwelling is reduced-rated.

Schedule 10, Part 2 (as amended by SI 2002/1102 and SI 2011/86) specifies when a taxable self-supply arises should the qualifying use of a certificated building cease or decrease or the building be disposed of.

The rules that ‘block’ developers from deducting input tax on goods that are not building materials are found in the VAT (Input Tax) Order 1992 (SI 1992/3222), articles 2 and 6 (as amended by SI 1995/281).

The special time of supply rules for builders are found in the Value Added Tax Regulations 1995 (SI 1995/2518), Regulations 89 and 93 (as amended by SI 1997/2887 and SI 1999/1374).

The rules for the self-supply of construction services are found in the Value Added Tax (Self-Supply of Construction Services) Order 1989 (SI 1989/472).

Paragraphs 18.1 and 18.2 have the force of law. The text of these paragraphs is indicated by a statement.

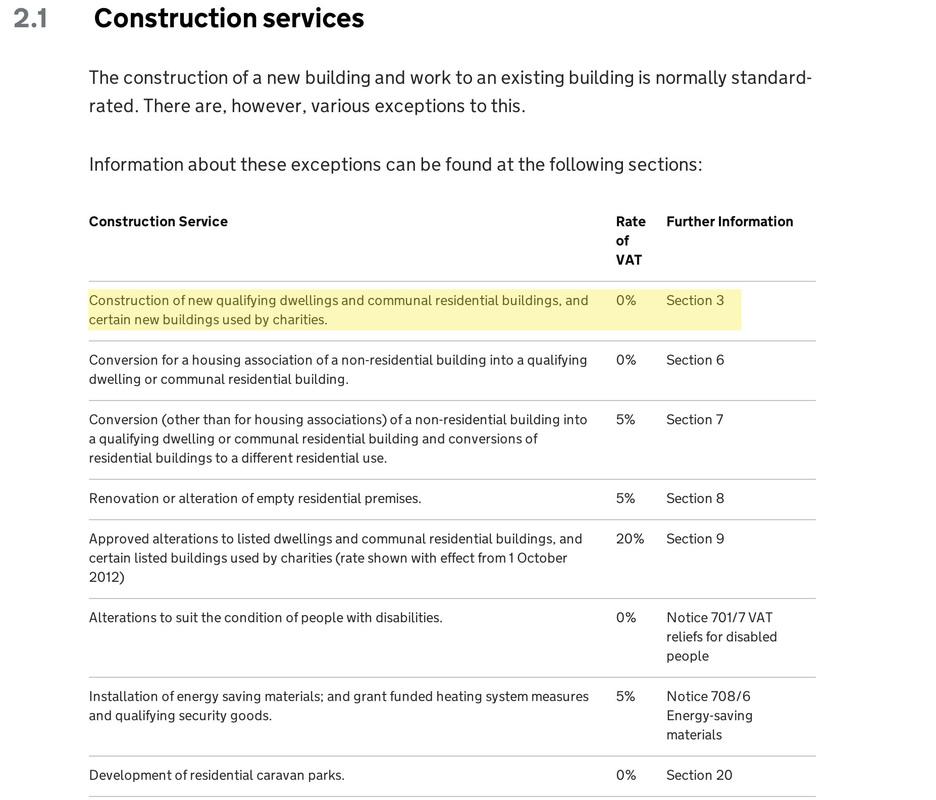

2. VAT liability

The construction of a new building and work to an existing building is normally standard-rated. There are various exceptions to this.

| Construction service | Rate of VAT | Further information |

|---|---|---|

| Construction of new qualifying dwellings and communal residential buildings, and certain new buildings used by charities | 0% | section 3 |

| Conversion for a housing association of a non-residential building into a qualifying dwelling or communal residential building | 0% | section 6 |

| Conversion (other than for housing associations) of a non-residential building into a qualifying dwelling or communal residential building and conversions of residential buildings to a different residential use | 5% | section 7 |

| Renovation or alteration of empty residential premises | 5% | section 8 |

| Approved alterations to listed dwellings and communal residential buildings, and certain listed buildings used by charities (rate shown with effect from 1 October 2012) | 20% | section 9 |

| Alterations to suit the condition of people with disabilities | 0% | Reliefs from VAT for disabled and older people (VAT Notice 701/7) |

| Installation of energy saving materials; and grant funded heating system measures and qualifying security goods | 5% | Energy-saving materials and heating equipment (VAT Notice 708/6) |

| Development of residential caravan parks | 0% | section 20 |

| First time gas and electricity connections | 0% | Fuel and power (VAT Notice 701/19) |

| Installation of mobility aids for the elderly for use in domestic accommodation | 5% | Reduced rate VAT on mobility aids for older people |

| Home improvements on domestic property situated in the Isle of Man | 5% | Isle of Man VAT Notice Home improvements available from:Isle of Man Customs and Excise Advice CentreCustom HouseNorth QuayDouglasIsle of ManIM99 1AG(Telephone: 01624 648130)(Website: IoM Treasury) |

A combination of buildings may form a single dwelling, as long as they’re designed to function together for that purpose. For example, where you have 2 buildings, one building may comprise a lounge and kitchen, and the other comprises the bedrooms and bathroom. The buildings must be constructed or converted under a single project and single planning consent.

You apply the same VAT rate to retention payments as that applied to previous payments made under the contract. Further information on retention payments can be found in paragraph 23.1.2.

Subcontractors are contractors who work to other contractors. For the most part they can zero rate or reduce rate their supplies according to the building being constructed or worked on, as noted at paragraph 2.1.

But the exceptions are:

Retailers and builders merchants charge VAT at the standard rate on most items they sell.

Builders charge VAT on ‘building materials’ that they supply and incorporate in a building (or its site) at the same rate as for their work. Therefore, if their work is zero-rated or reduced-rated, then so are the ‘building materials’. But some items are not ‘building materials’ and remain standard-rated.

Further information on this can be found in sections 11 and 13.

The sale or lease of a building is zero-rated, standard-rated, exempt from VAT or outside the scope of VAT, depending on the circumstances.

This notice explains when the sale or lease of a building is zero-rated.

The first sale of, or long lease in a:

An explanation of when the sale or lease of a building is standard-rated or exempt from VAT can be found in Land and property (VAT Notice 742).

With the exception of certain specified costs (business entertainment, incorporated non-building materials, cars), you’re entitled to deduct input tax incurred on costs that you use or intend to use in making taxable supplies (including zero-rated supplies).

You cannot normally deduct input tax incurred on costs that relate to your exempt supplies. If your input tax relates to both taxable and exempt supplies, you can normally deduct only the amount of input tax that relates to your taxable supplies. Further information is in Partial exemption (VAT Notice 706).

3. Zero rating the construction of new buildings

If you construct a new building you will normally have to charge VAT at the standard rate. You may be able to zero rate your supply if you’re involved in constructing a qualifying building. A qualifying building can be a building:

The remainder of this section explains the detailed conditions that need to be met before you can zero rate your services.

If you supply and install goods with your services, you will also need to read section 11 and 12 to determine the liability of those goods.

Your services can be zero-rated when all of the following conditions are met:

For an explanation of when you may need to apportion your charges see paragraph 3.5.

The following table will help you decide if a qualifying building is being constructed.

| A qualifying building is constructed when | and it is |

|---|---|

| it’s built from scratch, and, before construction starts, any pre-existing building is demolished completely to ground level (cellars, basements and the ‘slab’ at ground level may be retained) - see paragraph 3.2.3the new building makes use of no more than a single facade (or a double facade on a corner site) of a pre-existing building, the pre-existing building is demolished completely (other than the retained facade) before work on the new building is started and the facade is retained as a condition or requirement of statutory planning consent or similar permission - see paragraph 3.2.3a new building is constructed against an existing building so that they share a wall but there is no internal access between them | either ‘designed as a dwelling or number of dwellings’ - see paragraph 14.2,orintended for use solely for a ‘relevant residential purpose’ - see paragraph 14.6,orintended for use solely for a ‘relevant charitable purpose’ - see paragraph 14.7 |

| an existing building is enlarged or extended and the enlargement or extension creates an additional dwelling or dwellings - see paragraph 3.2 | ‘designed as a dwelling or number of dwellings’ - see paragraph 14.2 |

| an annexe to an existing building is built - see paragraphs 3.2.5 to 3.2.9; | intended the annexe, or a part of it, be used solely for a ‘relevant charitable purpose’ - see paragraph 14.7 |

| a garage is built, or a building is converted into a garage | constructed or converted at the same time as, and intended to be occupied with, a building ‘designed as a dwelling or number of dwellings’ - see paragraph 14.2 |

| a building is built that is one of a number of buildings constructed at the same time on the same site - see paragraph 3.2.2 | intended to be used together with those other buildings as a unit solely for a ‘relevant residential purpose’ - see paragraph 14.6 |

Common examples of work you cannot zero rate include the construction of a:

In determining whether a building has been demolished completely to ground level, you can ignore the retention of party walls that separate one building from another building that is not being demolished.

So, for example, you’re ‘constructing a building’ when you ‘infill’ in a row of terraced houses provided the pre-existing house is demolished completely to ground level apart from the party walls shared with the adjoining houses either side.

But if you’re re-developing adjoining houses in a terrace, the party wall between the houses being redeveloped will also need to be demolished before you’re seen to be ‘constructing a building’ for VAT purposes.

A party wall need not separate a building from another building, a party wall can also be the wall of a building on one property and a boundary or garden wall for the adjoining property. If such a wall is retained, the building in question cannot be said to have been demolished completely to ground level.

In order for zero rating to apply, a facade (or 2 facades in the case of a corner site) must be retained as a condition or requirement of a statutory planning consent or similar permission.

Planners may include this requirement as a condition within their planning consent letter. HMRC will also accept evidence that the planning authorities have seen an application with plans showing that a facade is to be retained and that approval has been granted for construction to proceed on that basis.

Once planning approval has been granted the construction must proceed in accordance with the submitted plans and from that point they become the ‘condition or requirement’.

You can zero rate the enlargement of, or extension to, an existing building to the extent that the extension or enlargement contains an additional dwelling provided both the following conditions are met, the:

So, for example, a new eligible flat built on top of an existing building can be zero-rated.

If the new dwelling is partly or wholly contained within the existing building, you cannot zero rate your work under the rules in this section. You may be able to reduce rate your charge as a ‘changed number of dwellings conversion’ - the rules are explained in section 7. Also, the sale or long lease of the new dwelling could be zero-rated as a converted non-residential building - the rules are explained in section 5.

The construction of a building intended for use solely for a relevant charitable purpose is zero-rated, with additions to an existing building normally being standard-rated. But the addition (or where only part of the addition is being used solely for a relevant charitable purpose, that part) can be zero-rated when all the following conditions are met:

The demolition and reconstruction of an annexe to an existing building can be zero-rated subject to the conditions being met.

The demolition and reconstruction of part of an existing building, such as the wing of a building, or the conversion of an existing building (or part) to an annexe cannot be zero-rated as the construction of an annexe.

An annexe can be either a structure attached to an existing building or a structure detached from it. A detached structure is treated for VAT purposes as a separate building. The comments in this section only apply to attached structures.

There is no legal definition of ‘annexe’. In order to be considered an annexe, a structure must be attached to an existing building but not in such a way so as to be considered an enlargement or extension of that building.

An enlargement or extension would involve making the building bigger so as to provide extra space for the activities already carried out in the existing building. Examples of an enlargement or extension are a classroom or a sports hall added to an existing school building or an additional function room (or kitchen or toilet block) added to an existing village hall.

On the other hand, an annexe would provide extra space for activities distinct from but associated with the activities carried out in the existing building. The annexe and the existing building would form 2 separate parts of a single building that operate independently of each other.

Examples of an annexe are a day hospice added to an existing residential hospice, a self-contained suite of rooms added to an existing village hall, a church hall added to an existing church or a nursery added to a school building.

When determining the second condition at paragraph 3.2.5, the annexe need not be an annexe to a building used solely for a relevant charitable purpose. What’s important is that the annexe itself is intended for use solely for a relevant charitable purpose. For an explanation of what relevant charitable purpose means see paragraph 14.7.

Where only a part of the annexe is intended for use solely for a relevant charitable purpose, you can only zero rate your supply to the extent that it relates to that part. The apportionment rules in section 16 apply in the same way to the construction of relevant charitable annexes as they do to the construction of buildings.

For zero rating to apply the whole annexe must be capable of functioning independently from the existing building, even if only part of it is intended to be used solely for a relevant charitable purpose.

An annexe is capable of functioning independently when the activities in the annexe can be carried on without reliance on the existing building. You can ignore the existence of building services (electricity and water supplies) that are shared with the existing building.

The fourth condition at paragraph 3.2.5 is that the annexe and the existing building must each have its own independent main access. So, even if the annexe has its own entrance the:

Your services are supplied ‘in the course of the construction’ when you carry out:

Completion takes place at a given moment in time. That point in time is determined by weighing up the relevant factors of the project, such as:

Once construction is ‘complete’, any further supplies of construction services (other than those mentioned at paragraph 3.3.6) are no longer ‘in the course of construction’ and are thus ineligible for the zero rate.

A developer is in the process of constructing a house for sale. The house buyer would like the house to include an attached conservatory and so contracts with a conservatory specialist to supply and install the conservatory prior to them moving in. The developer refuses the conservatory supplier access to the site until after they have finished their work and the house has been conveyed to the house buyer. In such circumstances, the supply by the conservatory supplier is not work ‘in the course of the construction’ of the house but work to an existing building and cannot be zero-rated.

A developer constructs and sells ‘shell’ loft apartments for fitting out by the homebuyer. When the developer sells the lofts, their construction would not be ‘complete’. Future work to fit them out can be zero-rated until such time as they’re habitable.

A non-fee paying school obtains planning permission to construct a building that will be used solely for a relevant charitable purpose. But due to limited funds, the extent of the work is scaled down and a smaller building is constructed instead. Funds are later obtained to extend and enlarge the building to produce a building of the same capacity as originally planned

In such circumstances, the building would be ‘complete’ at the end of the first set of works and the later works are standard-rated.

You may also need to bear in mind, the length of the interval between construction phases, the reason for the interval and the nature of the construction works in the second phase.

Snagging (or the correction of faults) is often carried out after the building has been ‘completed’. The work forms part of a zero-rated building contract, provided you carried out the initial building work and the snagging forms part of that building contract.

If you’re carrying out the work as a separate supply (you may, for example, be contracted to correct faults where the original work was carried out by another person) and it is performed after the building has been completed, then the work is to an existing building and cannot be zero-rated under the rules in this section.

Subject to paragraph 3.3.6, your work is closely connected to the construction of the building when it either:

(a) allows the construction of the building to take place, such as when you:

(b) produces works that allow the building to be used, such as works in connection with the:

The planting of shrubs, trees and flowers would not normally be seen as being ‘closely connected…’ except to the extent that it’s detailed on a landscaping scheme approved by a planning authority under the terms of a planning consent condition. This does not include the replacement of trees and shrubs that die, or become damaged or diseased.

It’s not possible to produce an exhaustive list of services that are closely connected to the construction of the building, and each case not included in (a) and (b) must be looked at on its own merits.

You need not be the main contractor in order for your supplies to be considered to be ‘works closely connected…’. You can be a subcontractor or another contractor.

Examples of work that are unconnected to the construction of a building include:

Further information on planning gain agreements can be found in Land and property (VAT Notice 742).

If you carry out services either before or after the physical construction of the building takes place, they can only be seen as closely connected if there’s a close connection between when they’re performed and when the physical construction of the building takes place.

Services described in paragraph 3.3.4 may be zero-rated (subject to the conditions in paragraph 3.1.2) where, for example:

Services in paragraph 3.3.4 are standard-rated where, for example:

The connection of utilities to an existing building is normally standard-rated. But in some cases, the first time connection of gas or electricity may be reduce-rated.

Further information can be found in Fuel and power (VAT Notice 701/19).

The supply of architectural, surveying, consultancy and supervisory services is always standard-rated. These services are procured in a number of ways.

The building client engages a contractor to carry out both the design and construction elements of the project. Where it’s clear in the contract that any services of architects, surveyors or others acting as a consultant or in a supervisory capacity are no more than cost components of the contractors supply and are not specifically supplied on to the customer, then the whole supply can be treated as being eligible for the zero rate.

The building client engages an external consultant to plan, manage and co-ordinate the whole project including establishing competitive bids for all elements of the work, with the successful contractors being employed directly by the building client. Management fees paid by the building client to the consultants are standard-rated.

This system can take various forms. Normally the building client first appoints a professional design team and engages a management contractor to advise them. If the project goes ahead, the management contractor will act as the main contractor for the work (engaging ‘works contractors’ to carry out work to them as necessary). Their preliminary advisory services are then treated in the same way as their main construction services. If the project does not go ahead, their preliminary advisory services are standard-rated.

Goods hired on their own are always standard-rated. Examples include the hire of:

If goods that belong to your business are put to a temporary private use outside of the business (such as if you use plant and equipment at home or lend them to a friend), then you’re making a taxable supply of services - see VAT guide (VAT Notice 700) for more information. Such supplies are not zero-rated under the rules in this section.

If you construct a building that is only in part a zero-rated building (see paragraph 3.2), you can only zero rate your work to the qualifying parts. For example, if you construct a building containing a shop with a flat above, then only the construction of the flat can be zero-rated. This is explained further at section 16.

Where a service is supplied in part in relation to the construction of a zero-rated building and in part for other purposes, a fair and reasonable apportionment may be made to determine the extent to which the supply is treated as being zero-rated.

A road is built through a development site where both zero-rated and standard-rated buildings are being constructed. The road serves all the buildings and so the work is carried out, in part, in relation to the construction of the zero-rated buildings and, in part, in relation to the construction of the standard-rated buildings. The liability of installing the road may be apportioned on a fair and reasonable basis, to reflect the buildings being served.

If you decide not to make an apportionment then none of your work can be zero-rated.

4. Zero rating the sale of, or long lease in, new buildings

The sale of, or lease in, a building can be zero-rated, standard-rated, exempt from VAT or outside the scope of VAT depending on the circumstances. If you have constructed a ‘qualifying’ building, that is a building:

You may be able to zero rate your first sale of, or long lease in, the property. The remainder of this section explains the detailed conditions that need to be met before you can zero rate your supply.

For an explanation of when a developer cannot recover input tax on goods incorporated in a zero-rated building see section 12.

If you cannot zero rate your supply you should read Land and property (VAT Notice 742) to determine if your supply is standard-rated or exempt. Remember, you cannot normally deduct input tax incurred on costs that relate to your exempt supplies. If your input tax relates to both taxable (including zero-rated) and exempt supplies, you can normally deduct only the amount of input tax that relates to your taxable supplies. Further information can be found in Partial exemption (VAT Notice 706).

Your supply can be zero-rated when all of the following conditions are met:

For an explanation of when you may need to apportion your charges see paragraph 4.8.

You’re granting a major interest in a building when you sell, assign or surrender:

If you intend to make a zero-rated grant of a major interest in a building (thereby recovering input tax on costs related to the construction and intended sale) but make a short lease in it (say due to a downturn in the property market) before making the zero-rated supply, you may need to make an adjustment to any input tax you have claimed.

The amount of adjustment will depend on your future intentions.

Further information on input tax and partial exemption can be found in Partial exemption (VAT Notice 706).

Where a grant of a major interest is either a long lease or a tenancy agreement, zero rating is restricted to the premium or the first rental payment made in respect of that grant. Subsequent payments are exempt.

The effect of this is that a developer is able to treat as input tax attributable to a taxable supply, the VAT incurred on construction and selling costs. The VAT incurred on ongoing maintenance costs is attributable to the exempt supplies.

Further information on input tax and partial exemption can be found in Partial exemption (VAT Notice 706).

Shared ownership arrangements involve the sharing of equity in a dwelling between, typically, an occupier and a housing association. The occupier purchases a dwelling at a proportion of its value and then pays rent to cover the share in the retained equity. Occupiers have the option of increasing their share of the equity by making additional payments, acquiring a further share related to the current value of the property (‘staircasing’). The rent is then reduced accordingly.

The initial payment by the occupier for their share of the equity can be zero-rated.

The subsequent rental payments and any additional ‘staircase’ payments are not zero-rated but exempt.

The effect of this is that a developer is able to treat as input tax attributable to a taxable supply, the VAT incurred on construction and selling costs. The VAT incurred on ongoing maintenance costs is attributable to the exempt supplies. Any VAT incurred on the costs of staircasing agreements is also attributable to exempt supplies.

Further information on input tax and partial exemption can be found in Partial exemption (VAT Notice 706).

For the purposes of the zero rate for grants of major interests, a ‘holiday home’ is a ‘building designed as a dwelling or number of dwellings’ where the person buying or leasing the property is:

The sale or long lease of a ‘holiday home’ cannot be zero-rated.

If the building is less than 3 years old when the sale or long lease takes place, the supply is standard-rated.

If the building is 3 years old or more, the supply is exempt but where a long lease is involved, the lease is only exempt to the extent that the consideration is in the form of a premium. Any subsequent payments for a lease, such as ground rents and service charges, are standard-rated.

Further information can be found in Hotels and holiday accommodation (VAT Notice 709/3).

Building work in the course of the construction of a ‘holiday home’ that is ‘designed as a dwelling’ is zero-rated when the conditions at paragraph 3.1.2 are met.

You’re a ‘person constructing’ a building if, in relation to that building, you’re acting as, or you have, at any point in the past, acted as a:

Multiple people can have ‘person construction’ status, but ‘person constructing’ status is not transferred when you transfer property. Instead each person must meet the conditions at paragraph 4.5.1.

An example is where a developer takes over and finishes a partly completed building. Both the first and second developers have ‘person constructing’ status because they have both been involved in physically constructing the building.

For an explanation of when the sale of a partly constructed building is zero-rated, see paragraph 4.7.4.

You can inherit ‘person constructing status’ when you acquire a new, completed residential or charitable development as part of a transfer of a going concern (TOGC) (see paragraph 4.5.6).

For VAT purposes, any business carried on by a member of a VAT group is treated as carried on by the representative member. But when determining whether a supply can be zero-rated, ‘person constructing’ status is only considered from the perspective of the group member who, in reality, makes the supply. This need not be the representative member.

For example a VAT group includes a:

Sometimes the beneficial owner of a property must register for VAT instead of the legal owner - further information can be found in Land and property (VAT Notice 742). In such circumstances the beneficial owner must have ‘person constructing’ status before the sale or long lease of the property can be zero-rated.

A person acquiring a completed residential or charitable development as part of aTOGCinherits ‘person constructing’ status and is capable of making a zero-rated first major interest grant in that building or part of it as long as:

a) a zero-rated grant has not already been made of the completed building or relevant part by a previous owner (not including the grant that gives rise to theTOGC)

b) the person acquiring the building as aTOGCwould suffer an unfair VAT disadvantage if its first major interest grants were treated as exempt (for example, a developer restructures its business - this entails the transfer (as aTOGC) of its entire property portfolio of newly constructed residential or charitable buildings to an associated company, which will make first major interest grants - if these were treated as exempt, the transferee might become liable to repay input tax recovered by the original owner on development costs under the capital goods scheme or partial exemption ‘clawback’ provisions and would incur input tax restrictions on selling fees that would not be suffered by businesses in similar circumstances - we would consider this to be an unfair disadvantage)

c) that person would not obtain an unfair VAT advantage by being in a position to make zero-rated supplies (for example, by recovering input tax on a refurbishment of an existing building)

Subject to the conditions at paragraph 4.1.2, you can only zero rate your first sale of, or long lease (see paragraph 4.2) in, a building (or part of a building). Zero rating is not affected by:

If you enter into a second or subsequent long lease in the building (or sell the building after leasing it on a long lease) you cannot zero rate your supply and it would normally be exempt from VAT - for further information see Land and property (VAT Notice 742).

The grant of a major interest between 2 members of the same VAT group is ignored for VAT purposes. It’s the first grant of a major interest to a person outside of the group that is the first grant for the purposes of zero rating.

The member of the group actually making that grant must have ‘person constructing’ status (see paragraph 4.5.4). Under VAT grouping rules all supplies are considered to be made by the representative member, but this will not prevent zero rating from applying if the member that would make the supply but for this rule has ‘person constructing’ status.

If you’re making a zero-rated sale of, or long lease in, a building or dwelling you can normally zero rate with the sale or long lease:

Further information on grants of parking facilities with dwellings can be found in Land and property (VAT Notice 742).

The sale of bare building land is not zero-rated and would be exempt from VAT, unless an option to tax has been taken out.

If the land contains civil engineering works (roads, water and electricity supplies) but no building is yet under construction, the sale would also be exempt from VAT unless an option to tax has been taken out.

Further information on the option to tax can be found in Opting to tax land and buildings (VAT Notice 742A).

If you sell land to someone and, at the same time, enter into a separate construction contract with them to build on what will be their land, you’re making 2 supplies and the VAT liability of each supply should be considered independently. The VAT liability of constructing new buildings is explained in section 3.

You can also zero rate along with the zero-rated sale or long lease of a building designed as a dwelling or number of dwellings, a new garage or a garage resulting from the conversion of a non-residential building provided that the garage:

Subject to the conditions at paragraph 4.1.2, you can zero rate the sale of, or long lease in, land that will form the site of a building provided a building is clearly under construction.

If you sell or long lease a plot where a building is clearly not under construction, your supply is not zero-rated and you should follow the guidance at paragraph 4.7.2.

If you sell or long lease a building (or part of a building) that’s only in part a zero-rated building, then you must apportion your supply. This is explained further at section 16.

If you sell or long lease qualifying buildings along with non-qualifying buildings or land that does not form part of the site of the qualifying buildings (see paragraph 4.6.1), you must apportion your supply between them on a fair and reasonable basis.

You own building land and commence constructing qualifying houses on identifiable plots. You then sell the whole site. The sale of the houses and their plots will be zero-rated but not the remaining building land or the infrastructure (roads, footpaths) leading to the house plots. The sale in that part of the development will be exempt, subject to any option to tax being taken out.

If you’re selling to another developer who will continue with the development, the sale may be outside the scope of VAT as theTOGC. Further information can be found in Transfer a business as a going concern (VAT Notice 700/9).

You own building land and develop a number of commercial buildings on it. You sell the freehold of the developed site to a charity but they can only certify that one of the buildings will be used solely for a relevant charitable purpose. Only the part of the sale attributable to that building and its site, can be zero-rated. The part of the sale attributable to the other buildings will be standard-rated if the buildings are less than 3 years old or exempt if the buildings are older, subject to any option to tax.

Further information on the treatment of buildings that do not qualify for the zero rate and the option to tax can be found in Land and property (VAT Notice 742) and Opting to tax land and buildings (VAT Notice 742A).

5. Zero rating the sale of, or long lease in, non-residential buildings converted to residential use

The sale of, or lease in, a building can be zero-rated, standard-rated, exempt from VAT or outside the scope of VAT depending on the circumstances. If you convert a non-residential building into a:

You may be able to zero rate your first sale of, or long lease in, the converted property. Non-residential buildings include residential buildings that have not been lived in for at least 10 years.

The remainder of this section explains the detailed conditions that need to be met before you can zero rate your supply.

For an explanation of when a developer cannot recover input tax on goods incorporated in a zero-rated building see section 12.

If you cannot zero rate your supply you should read Land and property (VAT Notice 742) to determine if your supply is standard-rated or exempt. You cannot normally deduct input tax incurred on costs that relate to your exempt supplies. If your input tax relates to both taxable (including zero-rated) and exempt supplies, you can normally deduct only the amount of input tax that relates to your taxable supplies. Further information can be found in Partial exemption (VAT Notice 706).

Your supply can be zero-rated when all of the following conditions are met:

For an explanation of when you may need to apportion your charges see paragraph 5.8.

You’re granting a major interest in a building when you sell, assign or surrender:

A ‘non-residential conversion’ takes place in 2 situations. The first is when the building (or part) being converted has never been used as a dwelling or number of dwellings (see paragraph 5.3.1) for a ‘relevant residential purpose’ (see paragraph 14.6), and it is converted into a building ‘designed as a dwelling or number of dwellings’ (see paragraph 14.2), or intended for use solely for a ‘relevant residential purpose (see paragraph 14.6).

The second situation requires that in the 10 years immediately before (see paragraph 5.3.2) the sale or long lease, the building (or part) has not been used as a dwelling or number of dwellings or for a ‘relevant residential purpose’ and it is converted into a building either ‘designed as a dwelling or number of dwellings’ (see paragraph 14.2), or intended for use solely for a ‘relevant residential purpose’ (see paragraph 14.6).

Examples of a ‘non-residential conversion’ into a building ‘designed as a dwelling or number of dwellings’ include the conversion of:

The conversion of a garage, occupied together with a dwelling, into a building designed as a dwelling is not a non-residential conversion.

The term ‘garage’ not only covers buildings designed to store motor vehicles but also buildings such as barns, to the extent that they’re used as garages.

But if it can be established that the garage was never used to store motor vehicles or has not been used as a garage for a considerable length of time prior to conversion, its conversion into a building designed as a dwelling can be a non-residential conversion.

A building is ‘used as a dwelling’ when it has been designed or adapted for use as someone’s home and is so used. The living accommodation need not have been self-contained or to modern standards. So, buildings that have been ‘used as a dwelling’, include:

If you convert these types of property into a building ‘designed as a dwelling or number of dwellings’, or intended for use solely for a ‘relevant residential purpose’, then, unless the 10-year rule applies, your sale of, or long lease in, the property cannot be zero-rated and is exempt from VAT.

You cannot normally zero rate the sale of, or long lease in, a building that has previously been lived in. Subject to the conditions at paragraph 5.1.2, the exception to this is where, in the 10 years immediately before you make your sale or long lease, it has not been lived in and following the work it is ‘designed as a dwelling’ or intended for use solely for a ‘relevant residential purpose’.

If you start work to convert the property into an eligible dwelling or residential building before the ten year point is reached, you can recover associated VAT costs as input tax provided that you intend to sell or make a long lease in it on or after the 10 year point has been reached. If you change your intention, you may have to repay any input tax that has been claimed. Further information can be found in Partial exemption (VAT Notice 706).

You may be required to show that the building has not been lived in during the 10 years immediately before you start your work. Proof of such can be obtained from Electoral Roll and Council Tax records, utilities companies, Empty Property Officers in local authorities, or any other source that can be considered reliable.

If you hold a letter from an Empty Property Officer certifying that the property has not been lived in for 10 years, you do not need any other evidence. If an Empty Property Officer is unsure about when a property was last lived in he should write with their best estimate. We may then call for other supporting evidence.

When considering when a dwelling was last lived in, you can ignore any:

A ‘guardian’ is a person who is installed in a property by the owner or on behalf of the owner in order to deter squatters and vandals. They may pay a low rent on terms that fall short of a formal tenancy. Alternatively, they may be paid to occupy the property.

A ‘guardian’ is to be distinguished from a caretaker or housekeeper who lives permanently in the property. Property occupied by a caretaker or housekeeper is likely to be furnished throughout.

If the dwelling has been lived in on an occasional basis (for example, because it was a second home) in the 10 years immediately before you sell or long lease the property, you cannot zero rate your supply.

To qualify for zero rating the conversion must only use non-residential parts of the building.

For example, you convert a 2-storey public house containing bar areas downstairs and private living areas upstairs (and so was in part being ‘used as a dwelling’ - see paragraph 5.3.1) into 2 flats, 1 being created out of the bar areas and 1 being created out of the private living area. The onward sale or long lease of the former is zero-rated but that of the latter will be exempt.

The onward sale or long lease of the house or houses cannot be zero-rated and is exempt when the conversion uses a mixture of non-residential parts of the building and other parts. This would include where you convert the same property into either:

For the purposes of the zero rate on grants of major interests, a ‘holiday home’ is a ‘building designed as a dwelling or number of dwellings’ where the person buying or leasing the property is:

The sale or long lease of a ‘holiday home’ cannot be zero-rated.

If, after conversion, the building is less than 3 years old when the sale or long lease is made, the sale or long lease is standard-rated. If the building is 3 years old or more, the sale or long lease is exempt. The long lease is exempt to the extent that the consideration is in the form of a premium.

Any subsequent payments for a lease, such as ground rents and service charges, are standard-rated.

Further information can be found in Hotels and holiday accommodation (VAT Notice 709/3).

You’re a ‘person converting’ a building if, in relation to that building, you’re acting as, or have, at any point in the past, acted as a:

More than one person can have ‘person converting’ status, but this status is not transferred when you transfer property. Instead each person must meet the conditions at paragraph 5.5.1.

An example is where a developer takes over and finishes a partly converted building. The first and second developers both have ‘person converting’ status because they have both been involved in physically converting the building.

For an explanation of when the sale of a partly converted building is zero-rated see paragraph 5.7.3.

The ‘person converting’ status can only be transferred when you have inherited this when you acquired a converted residential development as part of aTOGC(see paragraph 5.5.6).

For VAT purposes, any business carried on by a member of a VAT group is treated as carried on by the representative member, but when determining whether a supply can be zero-rated, ‘person converting’ status is only considered from the perspective of the group member who, in reality, makes the supply. This need not be the representative member.

For example a VAT group includes a:

Sometimes the beneficial owner of a property must register for VAT instead of the legal owner, further information can be found in Land and property (VAT Notice 742). In such circumstances the beneficial owner must have ‘person converting’ status before the sale or long lease of the property can be zero-rated.

A person acquiring a residential development that has been subject to a qualifying conversion as part of aTOGCinherits ‘person converting’ status and is capable of making a zero-rated first major interest grant in that building or part of it as long as:

a) a zero-rated grant has not already been made of the converted building or relevant part by a previous owner (not including the grant that gives rise to theTOGC)

b) the person acquiring the building as aTOGCwould suffer an unfair VAT disadvantage if its first major interest grants were treated as exempt (for example, a developer restructures its business - this entails the transfer (as aTOGC) of its entire property portfolio of newly constructed or converted qualifying buildings to an associated company, which will make first major interest grants - if these were treated as exempt, the transferee might become liable to repay input tax recovered by the original owner on development costs under the capital goods scheme or partial exemption ‘claw back’ provisions and would incur input tax restrictions on selling fees that would not be suffered by businesses in similar circumstances - we would consider this to be an unfair disadvantage)

c) that person would not obtain an unfair VAT advantage by being in a position to make zero-rated supplies (for example, by recovering input tax on a refurbishment of an existing building)

Subject to the conditions at paragraph 5.1.2, you can only zero rate your first sale of, or long lease (see paragraph 4.2) in, a building (or part of a building). Zero rating is not affected by:

If you enter into a second or subsequent long lease in the building (or sell the building after leasing it on a long lease) you cannot zero rate your supply and it would normally be exempt from VAT - for further information see Land and property (VAT Notice 742).

The grant of a major interest between 2 members of the same VAT group is ignored for VAT purposes. It’s the first grant of a major interest to a person outside of the group that is the first grant for the purposes of zero rating.

The member of the group actually making that grant must have ‘person converting’ status (see paragraph 5.5.4). Under VAT grouping rules all supplies are considered to be made by the representative member, but this will not prevent zero rating from applying if the member that would make the supply but for this rule has ‘person constructing’ status.

If you’re making a zero-rated sale of, or long lease in, a building or dwelling you can normally zero rate with the sale or long lease:

Further information on grants of parking facilities with dwellings can be found in Land and property (VAT Notice 742).

You can also zero rate along with the zero-rated sale or long lease of a building designed as a dwelling or number of dwellings, a new garage or a garage resulting from the conversion of a non-residential building provided that the garage:

Subject to the conditions at paragraph 5.1.2, you can zero rate the sale of, or long lease in, a building where a real and meaningful start on the conversion has been made. This means that the work must have been more than securing or maintaining the existing structure.

You can only zero rate the sale of, or long lease in, a building (or part of a building) when the new qualifying residential accommodation is created wholly from a non-residential building or part of a building. If you carry out a mixture of qualifying and non-qualifying conversions in a building you can zero rate the sale of, or long lease in, the qualifying parts and apportion your charge. For example you convert a:

If you sell or long lease a development site containing a mixture of buildings that qualify for zero rating as the conversion of a non-residential building (or part of a building) and other buildings, you must apportion the liability of your supply between them on a fair and reasonable basis.

6. Zero rating the conversion of non-residential buildings for relevant housing associations

If you carry out work to an existing building you will normally have to charge VAT at the standard rate or the reduced rate. You may be able to zero rate your supply if you provide conversion services to a relevant housing association and during the course of your work you convert a non-residential building into a:

The remainder of this section explains the detailed conditions that need to be met before you can zero rate your services.

If you supply and install goods with your services, you will also need to read section 11 to determine the liability of those goods.

Your services can be zero-rated when all of the following conditions are met:

For an explanation of when you may need to apportion your charges see paragraph 6.6.

A ‘relevant housing association’ is a:

It’s advisable to hold evidence to show that your customer is a relevant housing association, such as a copy of their registration certificate, as you may be asked by HMRC to show why your services are zero-rated.

If you’re converting the building into a building intended for use solely for a ‘relevant residential purpose’, you must also hold a certificate confirming the intended use of the building. Further information on certificates can be found in section 17.

Subcontractors services are not made directly to a relevant housing association and are, therefore, not zero-rated (see paragraph 2.1.2).

A ‘non-residential conversion’ takes place when:

It’s converted into a building:

Examples of a ‘non-residential conversion’ into a building designed as a dwelling or number of dwellings include the conversion of:

The conversion of a garage, occupied together with a dwelling, into a building designed as a dwelling is not a non-residential conversion.

The term ‘garage’ not only covers buildings designed to store motor vehicles but also buildings such as barns to the extent that they’re used as garages.

But if it can be established that the garage was never used to store vehicles or has not been used as a garage for a considerable period of time prior to conversion, its conversion into a building designed as a dwelling can be a non-residential conversion.

A building is ‘used as a dwelling’ when it has been designed or adapted for use as someone’s home and is so used. The living accommodation need not have been self-contained or to modern standards. So, buildings that have been ‘used as a dwelling’, include:

If you convert these types of property into a building ‘designed as a dwelling or number of dwellings’, or intended for use solely for a ‘relevant residential purpose’, then, unless the 10-year rule applies, your services cannot be zero-rated.

You cannot normally zero rate work to a property that has previously been lived in. Subject to the conditions at paragraph 6.1.2, the exception to this is where, in the 10 years immediately before you start your work, it has not been lived in and following the work it is ‘designed as a dwelling’ or intended for use solely for a ‘relevant residential purpose’.

If the property starts being ‘used as dwelling’ or for a ‘relevant residential purpose’ whilst your work is being carried out, then any work that takes place after that point is not zero-rated.

You may be required to show that that the building has not been lived in during the 10 years immediately before you start your work. Proof of such can be obtained from Electoral Roll and Council Tax records, utilities companies, Empty Property Officers in local authorities, or any other source that can be considered reliable.

If you hold a letter from an Empty Property Officer certifying that the property has not been lived in for 10 years, you do not need any other evidence. If an Empty Property Officer is unsure about when a property was last lived in he should write with their best estimate. We may then call for other supporting evidence.

When considering when a dwelling was last lived in, you can ignore any:

A ‘guardian’ is a person who is installed in a property by the owner or on behalf of the owner to deter squatters and vandals. They may pay a low rent on terms that fall short of a formal tenancy. Alternatively, they may be paid to occupy the property.

A ‘guardian’ is to be distinguished from a caretaker or housekeeper who lives permanently in the property. Property occupied by a caretaker or housekeeper is likely to be furnished throughout.

If the dwelling has been lived in on an occasional basis (for example, because it was a second home) in the 10 years immediately before you start your work you cannot zero rate your supply.

To qualify for zero rating, the conversion must only use non-residential parts of the building.

For example, if you convert a 2-storey public house containing bar areas downstairs and private living areas upstairs (and so was in part being ‘used as a dwelling’ - see paragraph 6.3.1) into 2 flats, 1 being created out of the bar areas and 1 being created out of the private living area, only the conversion of the former can be zero-rated.

On the other hand, if the conversion uses a mixture of non-residential parts of the building and other parts, none of your services can be zero-rated.

None of your work would be zero-rated and you could not apportion your charge if you converted a 2-storey public house, containing bar areas downstairs and private living areas upstairs (and so was in part being ‘used as a dwelling’ - see paragraph 6.3.1) into either a:

You can zero rate work to construct a new garage, or to convert a non-residential building into a garage, provided that the:

Your services are supplied in the course of the conversion when you:

The supply of architectural, surveying, consultancy and supervisory services is always standard-rated.

For an explanation of when a standard-rated supply takes place under different types of building contracts and the treatment of ‘design and build’ contracts see paragraph 3.4.1.

Goods hired on their own are always standard-rated. Examples of standard-rated hire are given at paragraph 3.4.2.

If goods that belong to your business are put to a temporary private use outside of the business (such as if you use plant and equipment at home or lend them to a friend), then you’re making a taxable supply of services (for more information see VAT guide (VAT Notice 700)). Such supplies are not zero-rated under the rules in this section.

You can only zero rate your work when the new qualifying residential accommodation is created wholly from a non-residential building or part of a building - see paragraph 6.3.5. If this is not the case you cannot apportion your charge. But, you must apportion your charge on a fair and reasonable basis between qualifying conversion work and other work you do at the same time.

You convert a shop into a flat and refurbish existing flats above the shop that have been lived in within the last 10 years. You can zero rate the work to convert the shop but not the refurbishment of the flats.

Where a service is supplied in part in relation to the conversion of a non-residential building and in part for other purposes, a fair and reasonable apportionment may be made to determine the extent to which the supply is treated as being zero-rated.

A road that serves the building being converted and a neighbouring house (for example, a barn and a farmhouse) is upgraded as part of the conversion. As the road serves both buildings, the work carried out relates, in part, to the conversion and, in part, for other purposes. The liability of upgrading the road may be apportioned on a fair and reasonable basis.

If you decide not to make an apportionment then none of your work can be zero-rated.

7. Reduced rating the conversion of premises to a different residential use

If you carry out work to an existing building you will normally have to charge VAT at the standard rate. You may be able to charge VAT at the reduced rate of 5% if you’re converting premises into a:

The remainder of this section explains the detailed conditions that need to be met before you can reduce rate your services.

If you supply and install goods with your services, you will also need to read section 11 to determine the liability of those goods. If you install goods that are not building materials (such as carpets or fitted bedroom furniture) you must also standard rate your installation charge. This is explained further at paragraph 7.6.

Your services can be reduced-rated when all of the following conditions are met:

For an explanation of when you may need to apportion your charges see paragraph 7.7.

The following table summarises the types of conversion that are ‘qualifying conversions’. For full details you should read the appropriate paragraph.

| Dwellings | Single household dwellings - see paragraph 14.4 - after conversion | Multiple occupancy dwellings - see paragraph 14.5 - after conversion | Relevant residential purpose building - see paragraph 14.6 - after conversion |

|---|---|---|---|

| Single household dwellings before conversion | Not normally a qualifying conversion, but if there’s a change in the number of single household dwellings see paragraph 7.3 | see paragraph 7.4 | see paragraph 7.5 |

| Multiple occupancy dwellings before conversion | see paragraph 7.3 | Not a qualifying conversion | see paragraph 7.5 |

| Relevant residential purpose building before conversion | see paragraph 7.3 | see paragraph 7.4 | Not a qualifying conversion |

| Any premises not listed, such as a building that has never been lived in | see paragraph 7.3 | see paragraph 7.4 | see paragraph 7.5 |

A qualifying conversion is carried out when the premises being converted is a building, or part of a building, and after the conversion the premises contains a greater or lower number (but not less than one) of ‘single household dwellings’ (see paragraph 14.4), but not where the number of ‘single household dwellings’ in part of the premises is unchanged (see paragraph 7.3.1).

A qualifying conversion includes the conversion of:

It does not include the:

Work that is unrelated to changing the number of dwellings cannot be reduced-rated.

A block of flats consists of 4 floors, each with 4 flats. A lift is installed and work is carried out throughout the whole building. On the ground, first and second floors the footprint of each flat is changed to take account of the new lift. This results in the internal configuration of each flat being changed. On the third floor 3 penthouse flats are created from the original 4.

Although the overall number of single household dwellings in the building has changed (there has been a reduction by one unit) only the work to convert the third floor will be eligible for the reduced rate because it is only in this part of the building that the number of dwellings has changed. But see also the next example.

Taking example 1, if the reduction in the number of flats on the third floor happens by combining 2 of the original flats together, the other 2 being refurbished, then the reduced rate will only apply to the work to merge the 2 flats together.

Taking example 1, as well as the changes to the top floor, the number of flats on the ground floor is changed to 5 smaller units. In this example, the overall number of dwellings in the building has not changed (there are 16 units both before and after the work). But as parts of the building are examined independently, and because the respective parts of the building meet the conditions at paragraph 7.3, the reduced rate can apply to the work to convert those parts.

A qualifying conversion is carried out when a building, or part of a building, before conversion does not contain any multiple occupancy dwellings (see paragraph 14.5). After conversion, the premises contain only one or more multiple occupancy dwellings and the premises are not intended to be used to any extent for a relevant residential purpose (see paragraph 14.6).

A qualifying conversion includes the conversion into a multiple occupancy dwelling of a:

It does not include, for example, the creation of additional bedrooms at a dwelling consisting of bedsits.

A qualifying conversion is carried out when the premises being converted are one or more buildings or parts of buildings. Before conversion, those premises must not have been last used to any extent for a relevant residential purpose (see paragraph 14.6). After conversion, those premises are intended to be used solely for a relevant residential purpose.

A qualifying conversion includes the conversion into premises that will be used solely for a relevant residential purpose of a:

It does not include:

Other than installing goods that are building materials (see paragraph 13.8 for examples of building materials), you can also reduce rate any works of repair, maintenance (such as redecoration), or improvement (such as the construction of an extension or the installation of double glazing) carried out to the fabric of the building.

You can also reduce rate works within the immediate site of the premises being converted that are in connection with the:

All other services are standard-rated. For example, you must standard rate:

You can reduce rate the:

This is provided both these conditions are met:

But you cannot reduce rate the provision of a hardstanding unless it is also used as an access.

If you carry out work that requires statutory planning consent or statutory building control and it has not been granted, then your work is standard-rated.

You can only reduce rate those services detailed in paragraph 7.6 when they’re supplied in the course of a qualifying conversion. If your services cover a wider range of work then you may apportion your charge on a fair and reasonable basis. If you decide not to make an apportionment then none of your work can be reduced-rated.

8. Reduced rating the renovation or alteration of empty residential premises

If you carry out work to an existing building you will normally have to charge VAT at the standard rate. You may be able to charge VAT at the reduced rate of 5% if you’re renovating or altering either:

The remainder of this section explains the detailed conditions that need to be met before you can reduce rate your services.

If you supply and install goods with your services, you will also need to read section 11 to determine the liability of those goods. If you install goods that are not building materials (such as carpets or fitted bedroom furniture) you must also standard rate your installation charge. This is explained further at paragraph 8.4.

Your services can be reduced-rated when all of the following conditions are met:

For an explanation of when you may need to apportion your charges see paragraph 8.5.

‘Qualifying residential premises’ means a:

The premises being renovated or altered must be used solely for a ‘relevant residential purpose’ after the works have been carried out. The recipient of your supply must confirm this by giving you a certificate - see section 17.

Where a building, when last lived in, was one of a number of buildings on the same site used together as a unit for a relevant residential purpose (such as a number of buildings that together formed a care home) you need not renovate or alter all of the buildings for the reduced rate to apply. But those that are renovated or altered must be used together as a unit solely for a relevant residential purpose and a certificate issued.

You can only reduce rate the renovation or alteration if, in the 2 years immediately before renovation works start, the qualifying residential premises has not been lived in.

If the premises is a building (or part of a building) which, when last lived in, was 1 of a number of buildings on the same site used together as a unit for a relevant residential purpose, then none of the buildings making up the original unit must have been lived in during the 2 years immediately before your work starts. So you cannot, for example, reduce rate the renovation or alteration of a dormant building within the grounds of an operational home or institution.

If you reduced-rated your supply, you may be required to show that the building has not been lived in during the 2 years immediately before you start your work. Proof of such can be obtained from Electoral Roll and Council Tax records, utilities companies, Empty Property Officers in local authorities, or any other source that can be considered reliable.

If you hold a letter from an Empty Property Officer certifying that the property has not been lived in for 2 years, you do not need any other evidence. If an Empty Property Officer is unsure about when a property was last lived in, they should write with a best estimate. We may then call for other supporting evidence.

You can ignore any use that is:

A ‘guardian’ is a person who is installed in a property by the owner or on behalf of the owner to deter squatters and vandals. They may pay a low rent on terms that fall short of a formal tenancy. Alternatively, they may be paid to occupy the property.

A ‘guardian’ is to be distinguished from a caretaker or housekeeper who lives permanently on the property. Property occupied by a caretaker or housekeeper is likely to be furnished throughout.

If the dwelling has been lived in on an occasional basis (for example, because it was a second home) in the 2 years immediately before you start your work you cannot reduce rate your supply.

There are 2 empty house rules for situations when people are living in the premises while refurbishment work is being carried out. The first relates to all qualifying premises (see paragraph 8.2). The second only relates to ‘single household dwellings’.

If the ‘qualifying residential premises’ have not been lived in during the 2 years immediately before your work starts, all of your work is reduced-rated. This is the case even if the premises start to be lived in again while you are carrying out your work. The occupier must move in on a day after you start your work.

But if, when your work starts, the premises are already being lived in, or have been lived in during the previous 2 years, all of your work is standard-rated.

You can reduce rate your services of the refurbishment or alterations to a ‘single household dwelling’ where all the following conditions are met:

This exception to occupation will not apply to the renovation or alteration of multiple occupancy dwellings or buildings intended for use for a relevant residential purpose.

Other than installing goods that are building materials (see paragraph 13.8 for examples of building materials), you can also reduce rate any works of repair, maintenance (such as redecoration), or improvement (such as the construction of an extension or the installation of double glazing) carried out to the fabric of the dwelling.

You can also reduce rate works within the immediate site of the dwelling that are in connection with the:

All other services are standard-rated. For example, you must standard rate:

If premises consisting of a single household dwelling, multiple occupancy dwelling, or building used for a relevant residential purpose are renovated or altered at the reduced rate, you can also reduce rate the:

Both the following conditions must be met:

But you cannot reduce rate the provision of a hardstanding unless it is also used as an access.

If you carry out work that requires statutory planning consent or statutory building control and it has not been granted, then your work is standard-rated.

You can only reduce rate those services detailed in paragraph 8.4 when they’re supplied in the course of a qualifying renovation or alteration. If your services cover a wider range of work then you may apportion your charge on a fair and reasonable basis. If you decide not to make an apportionment then none of your work can be reduced-rated.

9. Transitional historical arrangements

Transitional historical arrangements for zero rating approved alterations to the first grant of a major interest in protected buildings.

This section has been retained because although all zero rating for approved alterations ended in September 2015 the information contained within it may still be required.

Prior to 1 October 2012 work undertaken in the course of an approved alteration to a protected building (but not including works of repair and maintenance) was treated as zero-rated. With effect from that date the zero rate has been withdrawn.

To mitigate the impact of the change a transitional relief was applied until 30 September 2015.

This means that supplies of approved alterations were standard-rated with effect from 1 October 2012 unless they qualified for:

For the remainder of this section present tense is retained although the conditions it describes are now historic.

Under the transitional arrangements, zero rating will continue to apply where in respect of the works a ‘relevant consent’ was applied for before 21 March 2012 or a written ‘contract’ was entered into before 21 March 2012; this included contracts already underway on 21 March 2012 (providing that this is supported by evidence).

For most buildings relevant consent means listed building consent. But where the building is a listed place of worship that is exempted from the usual listed building controls under section 60 of the Planning and (Listed Buildings Conservation Areas) Act I990 it will refer to whatever consent for the approved alterations is required by the competent authority.

The contract referred to in the transition arrangements is the written contract with the builder, not the architects’ plans, planning permission and so on.

The changes apply to the listed places of worship. But the government has extended the scope of the listed places for the worship grant scheme so that it covers alterations as well as repairs.

Applicable to works eligible for the period of transitional relief ending 30 September 2015.

If you carry out work to an existing building you will normally have to charge VAT at the standard rate. You may be able to zero rate your supplies if you’re involved in altering a listed building or scheduled monument which will:

The remainder of this section explains the detailed conditions that need to be met before you can zero rate your services.

If you supply and install goods with your services, you will also need to read section 11 to determine the liability of those goods.

Your services can be zero-rated when all of the following conditions are met:

For an explanation of when you may need to apportion your charges see paragraph 9.7.

A protected building is a building that is either a listed building (see paragraphs 9.3.2 and 9.3.3) or a scheduled monument (see paragraph 9.3.4) and is:

A listed building is one included in a statutory list of buildings of special architectural or historic interest compiled by the Secretary of State for National Heritage in England and by the Secretaries of State for Scotland, Wales and Northern Ireland.

In England and Wales there are 3 categories of listed building, Grade I, Grade II*, and Grade II. In Scotland the equivalent categories are Grade A, Grade B and Grade Cs. In Northern Ireland the equivalent categories are Grade A, Grade B+ and Grade B.

Buildings within the curtilage of a listed building such as outhouses or garages which, although not fixed to the building, form part of the land and have done so since before 1 July 1948 (for example, an outhouse) are treated for planning purposes as part of the listed building.

Unlisted buildings in conservation areas, or buildings included in a local authority’s non-statutory list of buildings of local interest, which used to be known as Grade III buildings, are not ‘protected’ buildings for VAT purposes.

As noted in paragraph 9.3.2, garages and other curtilage buildings can be treated for planning purposes as part of the listed building.

For VAT purposes any approved alteration carried out to such buildings can only be zero-rated if the building being altered falls within 1 of the descriptions in paragraph 9.3.1. For example, the conversion of an outhouse in the curtilage of a dwelling to a swimming pool cannot be zero-rated as that building is not ‘designed to remain as or become a dwelling’ in its own right.

Approved alterations to garages in the curtilage of a building ‘designed to remain as or become a dwelling’ can be zero-rated provided that the garage is occupied together with the dwelling, and was either constructed at the same time as the dwelling or, where the dwelling has been substantially reconstructed, at the same time as that reconstruction.

A garage need not be a building designed to store motor vehicles, the term can also apply to a building adapted to store motor vehicles such as a barn.

A scheduled monument is one included in a statutory schedule of monuments of national importance as defined in the Ancient Monuments and Archaeological Areas Act 1979 or the Historic Monuments and Archaeological Object (Northern Ireland) Order 1995.

You can only zero rate an approved alteration to a scheduled monument if it’s a building that meets the tests at paragraph 9.2.1.

A building is altered when its fabric, such as its walls, roof, internal surfaces, floors, stairs, windows, doors, plumbing and wiring is changed in a meaningful way.

Alterations carried out for the purposes of repair or maintenance, or any incidental alteration resulting from works of repair or maintenance, are always standard-rated, even if the work has been included in the listed building or scheduled monument consent.

Works of repair or maintenance are those tasks designed to minimise, for as long as possible, the need for, and future scale and cost of, further attention to the fabric of the building. Changes to the physical features of the building are not zero-rated alterations if, in the exercise of proper repair and maintenance of the building, they’re either:

Similarly, if the amount of work or cost is significant, that does not make the work a zero-rated alteration if the inherent character of the work is repair and maintenance.

The following are examples of repair or maintenance work and alterations. Remember you can only zero rate alterations when all of the conditions in paragraph 9.1.2 are met.

| Work | VAT treatment |

|---|---|

| Extensions | Alteration |

| Opening or closing doorways | Alteration |

| Replacement of rotten wooden windows withuPVCdouble glazing | Repair or maintenance |

| Replacement ofuPVCdouble glazing with copies of original wooden windows for aesthetic reasons | Alteration |

| Installing a window where one did not exist before | Alteration |

| Re-felt and batten roof | Repair or maintenance |

| Replacement of a flat roof with a pitched roof | Alteration |

| Replacement of straw thatch with reeds and changes to the ridge detail of a thatched roof | Repair or maintenance when carried out as part of the normal renewal programme |

| Damp proofing | Repair or maintenance |

| Making good | Follows the liability of the main work |

| Re-decorating | Repair or maintenance |

| Re-pointing | Repair or maintenance |

| Re-wiring | Repair or maintenance |

| Extending wiring and plumbing systems | Alteration |

| Replacing a boiler with a larger capacity boiler whilst extending plumbing systems | Alteration |

| Flood lighting | Alteration when installed on the building, but neither an alteration nor repair or maintenance (and therefore standard-rated) when installed within the grounds of a building - there is no work to the fabric of the building |

The Department of Culture Media and Sport administers a grant scheme for repairs to listed places of worship. The scheme can refund the full amount of VAT spent on eligible repairs, but this will depend on the funds available. Further information on the scheme can be obtained from:

Listed Places of Worship Grant SchemePO Box 609NewportNP10 8QD

Telephone: 0845 601 5945Website: www.lpwscheme.org.uk

Paragraph 9.3.3 explains that approved alterations to existing curtilage structures only qualify for zero rating when the structure is a protected building.

The construction of a building or structure in the grounds of a protected building is never an alteration of a protected building and is not zero-rated under the rules in this section. But zero rating may be available under the rules in section 3.

The construction of (and the alteration to) fences, walls and railings (both freestanding and attached to the protected building) and other curtilage structures, such as patios and terraces, are standard-rated.

In most cases an approved alteration is an alteration for which listed building consent is both needed and has been obtained from the appropriate planning authority (or, in some circumstances, the Secretary of State) prior to the commencement of the work. In each case you will need to find out from your customer (or their architect or surveyor) to what extent the work you have been contracted to do has both required and received listed building consent.

If you’re working on a church, a building on Crown or Duchy land, or a scheduled monument, you should read paragraphs 9.5.4, 9.5.5 and 9.5.6 respectively.

Listed building consent is not the same as planning permission. In general terms, listed building consent is needed for work on a listed building which would affect its character as a building of special architectural or historic interest. The construction of an extension, or alterations following partial demolition, would certainly require consent but it’s not possible to generalise about less radical work especially as regards internal alterations.

If you carry out work to a listed building without obtaining any required listed building consent, you’re committing an offence.

The planning authority cannot issue retrospective listed building consent for the work. But they may permit you to keep the unauthorised works. Such works are not approved alterations (because consent has not been granted at the time the work is carried out) and are standard-rated.