The Gold Rush for India's SuperApp

Late last year, when billionaire entrepreneur Gautam Adani announced his undisclosed investment in online travel aggregator Cleartrip — part of the Walmart-owned Flipkart group — the motive was explicit: to build a SuperApp by bundling a host of services on a single platform. For Adani, it means encapsulating an empire spanning fast-moving consumer goods [FMCG], power & gas utilities, airport management, data centres, ports and real estate. “The Cleartrip platform will become an essential part of the broader SuperApp journey we have embarked upon,” says Gautam Adani, chairman, Adani Group.

Besides Adani, the who’s who of India Inc. have embarked on to the next frontier in e-commerce—the SuperApp. Clouded in secrecy, some of India’s biggest conglomerates, etailers, banks andaggregators are capitalising on the growing App-fatigue to deliver an all-inclusive digital experience to consumers with an eye on their loyalty — and spending power. Their weapon of mass invasion: the SuperApp.

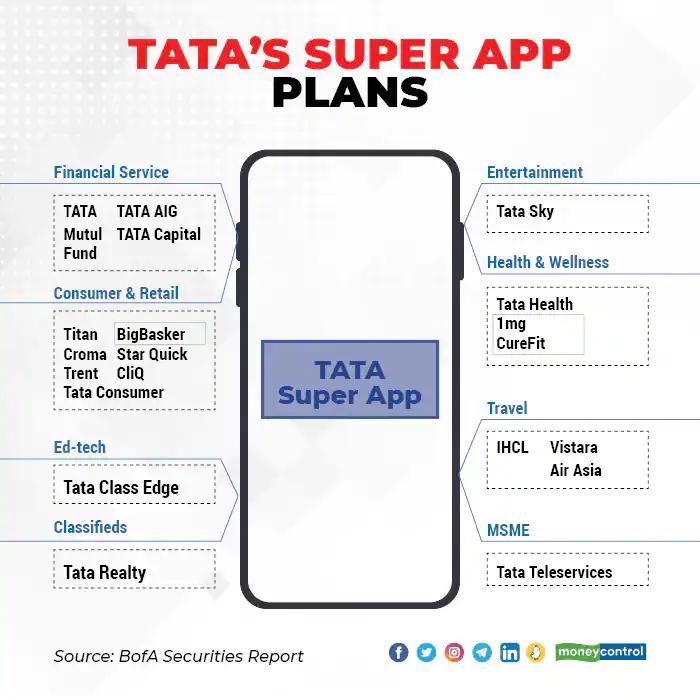

Reliance Industries Ltd. [RIL], the Tata group, Amazon, Flipkart, and Paytm are keeping the details of their SuperApp close to their chest but their actions leave a trail of their aspirations. Even large banks such as the State Bank of India, HDFC Bank and Kotak Mahindra Bank see it as a natural extension of their businesses.

In an age defined by hyper-targeting, hyper-personalisation and multi-platform consumers, the power of one is increasingly the superpower that everyone is after, says Piyush Sharma, executive-in-residence, UCLA, and a C-suite+ and start-up advisor. And that power can come from a SuperApp.

The opportunity is being thrown open by India’s booming consumer digital economy. Pegged at $90 billion in 2020, it is projected to be an $800-billion market by 2030, of which online retail will be a large slice, according to a RedSeer report. The online retail market is likely to grow to $350 billion in gross merchandise value (GMV) — the value of goods sold on a platform, barring discounts and returns — over the next decade from $55 billion this year. No consumer company can afford to miss this pie. According to an Ericsson Mobility Report, India already has 810 million smartphone subscriptions which will drive the app usage.

SuperApp 1.0

What is a SuperApp — a term coined by Blackberry founder Mike Lazaridis in 2010? It is a one-stop virtual platform that offers the convenience of diverse products and services such as marketplaces, ride hailing, food delivery, financial services, online messaging, social media, utilities and others under one umbrella. The best exponents of a SuperApp are Chinese tech conglomerate Tencent’s WeChat and Alibaba’s Alipay. Reason: The convenience of using a single app for any product or service a customer may need on a daily basis. Another one is Indonesia’s Go-Jek that started off as a two-wheeler ride-hailing service. Today, Go-Jek, which has expanded to Vietnam and Singapore, is used for ordering food, digital payments, shopping, hyper-local delivery, getting a massage and two dozen other services.

“A successful SuperApp will be more than just a platform-based business model. It will first need a killer habit for high-frequency usage with zero friction. Think WhatsApp or Paytm. On top of that, it will need to bring together a unified ecosystem. Think [RIL’s] Jio and its latest play for bundling over-the-top [OTT] streaming platforms,” says UCLA’s Sharma.

SuperApp will cover at least 40-50% of online transactions made by a large customer segment, adds Arpit Mathur, Partner at AT Kearney.