What Is Property, Plant, and Equipment (PP&E)?

Property, plant, and equipment are physical or tangible assets that are long-term assets that typically have a life of more than one year. Examples of property, plant, and equipment (PP&E) include:

Property, plant, and equipment assets are also called fixed assets, which are long-term physical assets. Industries that are considered capital intensive have a significant amount of fixed assets, such as oil companies, auto manufacturers, and steel companies.

Characteristics of Property, Plant, and Equipment (PP&E)

Fixed assets have a useful life assigned to them, which means that they have a set number of years of economic value to the company. Fixed assets also have a salvage value, which is the value remaining at the end of the asset's life. Salvage value is also called scrap value.

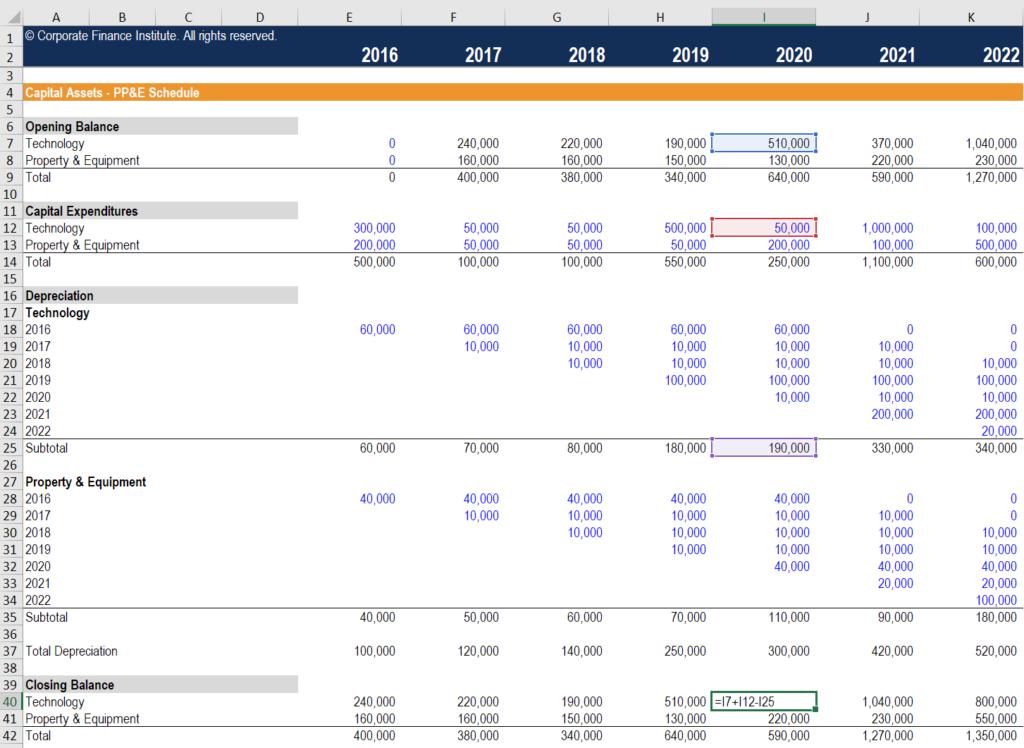

Meanwhile, fixed assets undergo depreciation, which divides the cost of fixed assets, expensing them over their useful lives. Depreciation helps a company avoid a significant cash outlay in the year the asset is purchased.

Tangible assets are depreciated for accounting purposes whereas intangible assets are amortized.

Depreciation also helps spread the asset's cost out over a number of years allowing the company to earn revenue from the asset.

How to Calculate Property, Plant, and Equipment (PP&E)

It's important for a company to accurately record its PP&E on its balance sheet. Analysts and potential investors will frequently review a company's PP&E to see where and how the company is spending its money on fixed assets in ways that could help the company increase its profitability.

It's also important for companies to track their PP&E in case they need to sell assets to raise money. While most fixed assets depreciate over time and are not easily converted to cash, some assets such as real estate can increase in value over time, providing a company with a possible option for raising cash.

Companies use the following formula to calculate PP&E:

Net PPE = Gross PPE + Capital Expenditures - Accumulated Depreciation

To determine net PP&E, add gross PP&E to capital expenditures. From this amount, subtract accumulated depreciation.

How Property, Plant, and Equipment (PP&E) Impacts Investors

Companies that are expanding may decide to purchase fixed assets to invest in the long-term future of the company. These purchases are called capital expenditures and significantly impact the financial position of a company. Whether a portion of available cash is used, or the asset is financed by debt or equity, how the asset is financed has an impact on the financial viability of the company.

It's important to know where a company is allocating its capital, whether the company is making capital expenditures, and how the company plans to raise the capital for its projects.

If new equity is issued, the stock price might decline due to the dilution of the shares. If cash is used, the company may be unable to pay dividends in future quarters. If the company obtains financing from a bank or private equity firm, the company will have debt-servicing costs associated with the additional long-term debt.

The Bottom Line

Property, plant, and equipment (PP&E) are the long-term, tangible assets that a company owns. They are most often fixed assets. PP&E, which includes trucks, machinery, factories, and land, allows a company to conduct and grow its business.

PP&E is depreciated over time and can be sold for its salvage value. When a company purchases PP&E, it is known as a capital expenditure. Proper management of capital expenditures is crucial to the growth and profitability of a company, so much so that investors analyze how a company manages its PP&E to determine if its capital expenditures will aid its success or be a drain on its funds.